Travel Guard

Cover your vacation with travel insurance. Card Player Cruises has teamed up with Travel Guard to bring you quality coverage during your vacation.

Common travel problems are why today’s smart travelers travel with a Travel Guard travel insurance plan. Below is a summary of plans available from Travel Guard. Also, be sure to check out the new product enhancements including pet, security, inconvience, wedding bundles. Click here to jump below and go directly to them. Contact Card Player Cruises for the most complete and current information.

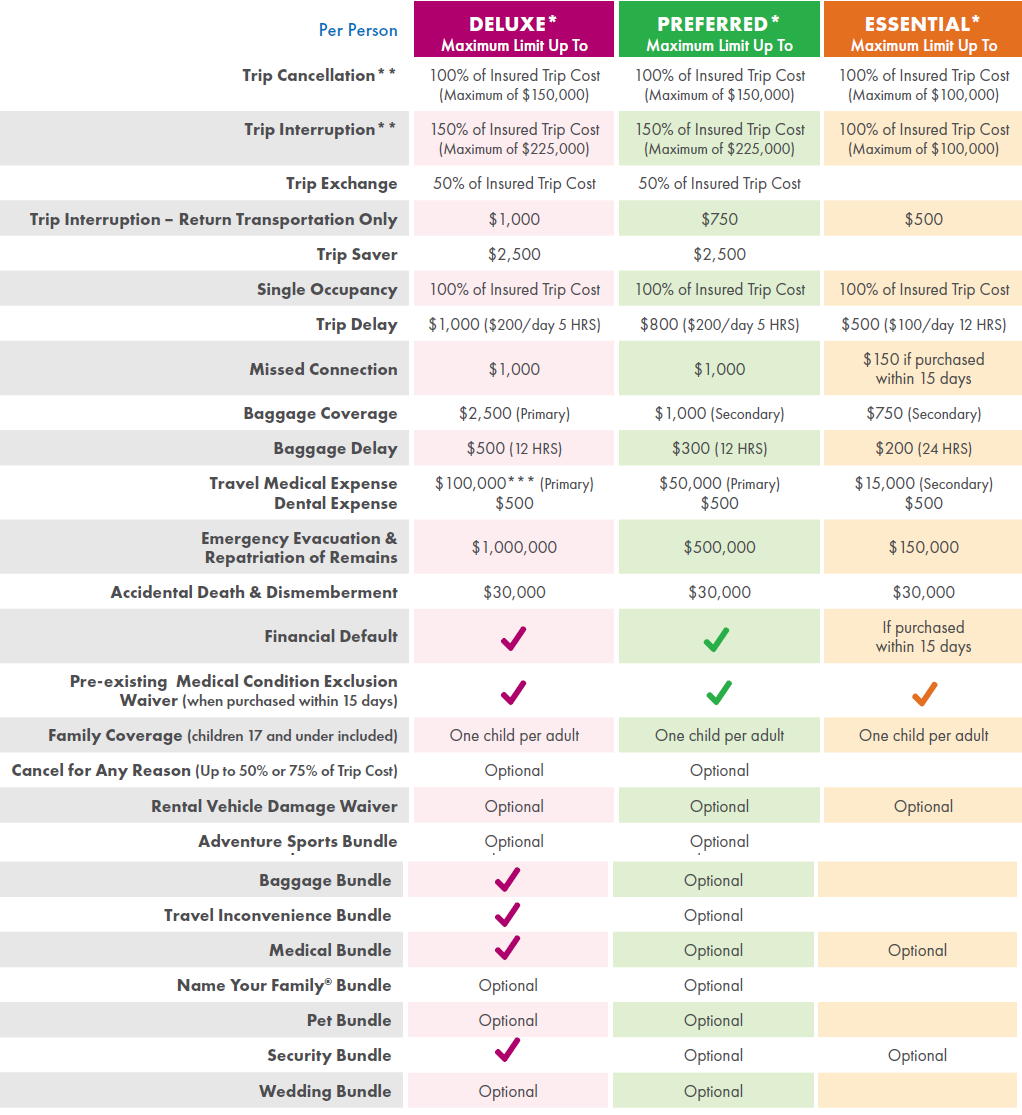

Essential Plan

Coverage may not be available in all states. Coverage varies by state. For complete coverage information and exclusions, please refer to the Policy of Insurance for your state of residency prior to purchase. This plan is not available to residents of CO, FL, IN, KS, MN, MO, MT, NY or WA.

To view a full listing of coverage benefits, please refer to the Policy of Insurance.

| Per Person | Maximum Limit Up To |

| Trip Cancellation | 100% of Insured Trip Cost* (Maximum of $100,000) |

| Trip Interruption | 100% of Insured Trip Cost* (Maximum 0f $100,000) |

| Trip Interruption – Return Transportation Only | $500 |

| Single Occupancy | 100% of Insured Trip Cost (Maximum of $100,000) |

| Trip Delay | $500 (Maximum $100/day,12 HRS) |

| Baggage Coverage | $750 (Secondary) |

| Baggage Delay | $200 (24 HRS) |

| Travel Medical Expense | $15,000 (Secondary) |

| Dental | $500 |

| Emergency Evacuation and Repatriation of Remains | $150,000 (Medical) |

| Accidental Death & Dismemberment | $30,000 |

| Assistance Services** Travel Medical Assistance, Worldwide Travel Assistance, Emergency Travel Assistance, Concierge Services, Personal Security Assistance |

Included |

Expenses incurred from third-party vendors for assistance services not part of a filed insurance plan are the responsibility of the traveler.

*Coverage only applicable to prepaid, non-refundable trip costs identified on the enrollment form and if the required plan cost has been paid. **Non-insurance services are provided by Travel Guard.

EXTRA COVERAGE

- Pre-Existing Medical Condition Exclusion Waiver

(Policy must be purchased within 15 days of the Initial Trip Payment. Day one is the date the initial payment is received. If the policy is not purchased within 15 days of the Initial Trip Payment, then a 180-day look-back period applies.) - Trip Cancellation and Interruption due to Financial Default

- $150 Missed Connection

ENHANCEMENT SUITE

The following insurance benefits will be included, if elected, and appropriate costs have been paid.

- Security Bundle: Coverage for security evacuation, Flight Guard® and Trip Cancellation or Interruption due to riot or civil disorder.

- Medical Bundle: Increases base plan medical expense and medical evacuation benefits.

- Rental Vehicle Damage Coverage: Reimburses up to the Maximum Limit shown on the Schedule of Benefits for physical damage to a rental car for which the car rental contract would hold you responsible.

Family Coverage: One child, age 17 and under, who is booked to travel with and is related to the primary adult named on the enrollment form, is included in the rates for each paying adult. Offer does not apply to optional coverages. The child’s trip cost must be equal to or less than the adult traveler(s) trip cost.

Preferred Plan

Coverage may not be available in all states. Coverage varies by state. For complete coverage information and exclusions, please refer to the Policy of Insurance for your state of residency prior to purchase. This plan is not available to residents of CO, FL, IN, KS, MN, MO, MT, NY or WA.

To view a full listing of coverage benefits, please refer to the Policy of Insurance.

| Per Person | Maximum Limit Up To |

| Trip Cancellation | 100% of Insured Trip Cost* (Maximum of $150,000) |

| Trip Interruption | 150% of Insured Trip Cost* (Maximum of $225,000) |

| Trip Exchange | 50% of Insured Trip Cost (Maximum of $75,000) |

| Trip Interruption – Return Transportation Only | $750 |

| Trip Saver | $2,500 |

| Single Occupancy | 100% of Insured Trip Cost (Maximum of $150,000) |

| Trip Delay | $800 (Maximum $200/day, 5 HRS) |

| Missed Connection | $1,000 |

| Baggage Coverage | $2,500 (Secondary) |

| Baggage Delay | $300 (12 HRS) |

| Travel Medical Expense | $50,000 (Primary)** |

| Dental | $500 |

| Emergency Evacuation and Repatriation of Remains | $500,000 (Medical) |

| Accidental Death & Dismemberment | $30,000 |

| Travel Inconvenience Benefits Flight Delay, Flight Cancellation, Runway Delay, Cruise Diversion, River Cruise Diversion |

$750 (aggregate) $250 limit per coverage |

| Ancillary Evacuation Benefits Includes: Return Transportation, Baggage Return |

$750 (aggregate) $250 limit per coverage |

| Assistance Services† Travel Medical Assistance, Worldwide Travel Assistance, Emergency Travel Assistance, Concierge Services, Personal Security Assistance, Identity Theft Assistance |

Included |

Expenses incurred from third-party vendors for assistance services not part of a filed insurance plan are the responsibility of the traveler.

*Coverage only applicable to prepaid, non-refundable trip costs identified on the enrollment form and if the required plan cost has been paid. **Non-insurance services are provided by Travel Guard.

EXTRA COVERAGE

- Pre-Existing Medical Condition Exclusion Waiver

(Policy must be purchased within 15 days of the Initial Trip Payment. Day one is the date the initial payment is received. If the policy is not purchased within 15 days of the Initial Trip Payment, then a 180-day look-back period applies.)

ENHANCEMENT SUITE

The following insurance benefits will be included, if elected, and appropriate costs have been paid.

- Pet Bundle: Daily benefit for boarding, and medical expense coverage for illness or injury of dog or cat while traveling. Includes coverage for Trip Cancellation or Interruption if your Pet is in critical condition or dies within seven days prior to the Departure Date.

- Security Bundle: Coverage for security evacuation, Flight Guard and Trip Cancellation or Interruption due to riot or civil disorder.

- Adventure Sports Bundle: Removes the exclusions for adventure and extreme activities from all benefits on the Policy.

- Medical Bundle: Increases base plan medical expense and medical evacuation benefits, and adds hospital of choice and additional evacuation benefits.

- Inconvenience Bundle: Payment for closed attractions, rental home lockout, credit/debit card cancellation, hotel infestation, hotel construction and more.

- Name Your Family® Bundle: Include one person to be deemed as a Family Member for the purpose of Family Member-related Unforeseen event coverage.

- Baggage Bundle: Baggage coverage becomes primary with increased base plan baggage coverage and baggage delay benefits.

- Cancel for Any Reason: Reimburses up to the Maximum Limit shown on the Schedule of Benefits if you cancel your Trip for any reason, not otherwise covered under the Policy, up to 48 hours prior to your scheduled departure.

- Rental Vehicle Damage Coverage: Reimburses up to the Maximum Limit shown on the Schedule of Benefits for physical damage to a rental car for which the car rental contract would hold you responsible.

- Wedding Bundle: Trip Cancellation due to wedding cancellation. Coverage does not apply if you are the bride or groom in the wedding.

Family Coverage: One child, age 17 and under, who is booked to travel with and is related to the primary adult named on the enrollment form, is included in the rates for each paying adult. Offer does not apply to optional coverages. The child’s trip cost must be equal to or less than the adult traveler(s) trip cost.

Deluxe Plan

Coverage may not be available in all states. Coverage varies by state. For complete coverage information and exclusions, please refer to the Policy of Insurance for your state of residency prior to purchase. This plan is not available to residents of CO, FL, IN, KS, MN, MO, MT, NY or WA.

To view a full listing of coverage benefits, please refer to the Policy of Insurance.

| Per Person | Maximum Limit Up To |

| Trip Cancellation | 100% of Insured Trip Cost* (Maximum of $100,000) |

| Trip Interruption | 150% of Insured Trip Cost* (Maximum of $225,000) |

| Trip Exchange | 50% of Insured Trip Cost (Maximum of $75,000) |

| Trip Interruption – Return Transportation Only | $1,000 |

| Trip Saver | $2,500 |

| Single Occupancy | 100% of Insured Trip Cost (Maximum of $150,000) |

| Trip Delay | $1,000 (Maximum $200/day, 5 HRS) |

| Missed Connection | $1,000 |

| Baggage Coverage | $2,500 (Primary) |

| Baggage Delay | $500 (12 HRS) |

| Travel Medical Expense | $100,000 (Primary)** |

| Dental | $500 |

| Emergency Evacuation and Repatriation of Remains | $1,000,000 (Medical) |

| Accidental Death & Dismemberment | $30,000 |

| Flight Guard | $100,000*** |

| Security Evacuation | $100,000 |

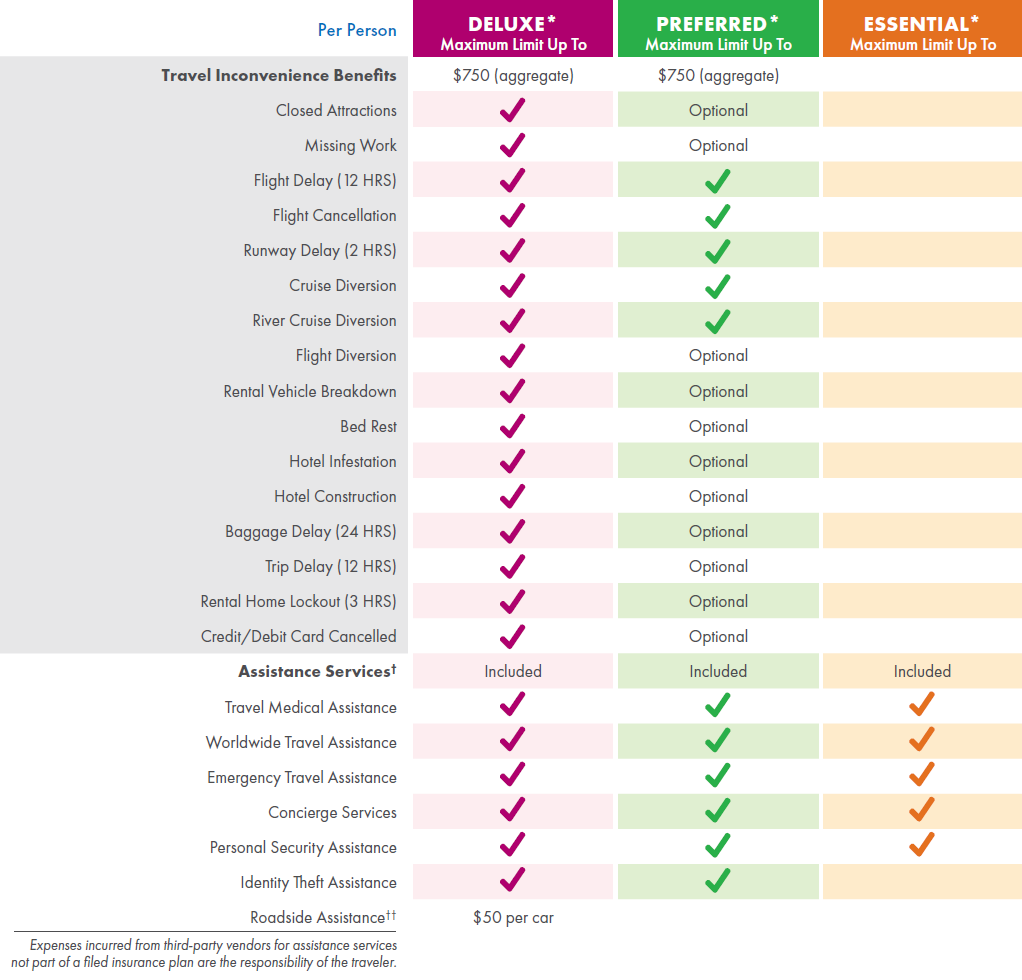

| Travel Inconvenience Benefits Closed Attractions, Missing Work, Flight Delay, Flight Cancellation, Runway Delay, Cruise Diversion, River Cruise Diversion, Flight Diversion, Rental Vehicle Breakdown, Bed Rest,Hotel Infestation, Hotel Construction, Baggage Delay (24 HRS), Trip Delay (12 HRS), Rental Home Lockout (3 HRS), Credit/Debit Card Cancelled |

$750 (aggregate) $250 limit per coverage |

| Ancillary Evacuation Benefits Includes: Return Transportation, Return of Children, Bedside Visit, Bedside Traveling Companion, Baggage Return |

$750 (aggregate) $250 limit per coverage |

| Assistance Services† Travel Medical Assistance, Worldwide Travel Assistance, Emergency Travel Assistance, Concierge Services, Personal Security Assistance, Identity Theft Assistance, Roadside Assistance (per car) $50†† |

Included |

Expenses incurred from third-party vendors for assistance services not part of a filed insurance plan are the responsibility of the traveler.

*Coverage only applicable to prepaid, non-refundable trip costs identified on the enrollment form and if the required plan cost has been paid. **$50,000 maximum for NH residents ***$50,000 for NH residents. †Non-insurance services are provided by Travel Guard. ††Provided by Quest Towing Services, LLC.

EXTRA COVERAGE

- Pre-Existing Medical Condition Exclusion Waiver (Must be purchased within 15 days of the Initial Trip Payment. Day one is the date the initial payment is received. If not purchased within 15 days of the Initial Trip Payment, then a 90-day look-back period applies. For residents of Idaho, 180-days.)

ENHANCEMENT SUITE

The following insurance benefits will be included, if elected, and appropriate costs have been paid.

- Pet Bundle: Daily benefit for boarding, and medical expense coverage for illness or injury of dog or cat while traveling. Includes coverage for Trip Cancellation or Interruption if your Pet is in critical condition or dies within seven days prior to the Departure Date.

- Adventure Sports Bundle: Removes the exclusions for adventure and extreme activities from all benefits on the Policy.

- Name Your Family® Bundle: Include one person to be deemed as a Family Member for the purpose of Family Member-related Unforeseen event coverage.

- Cancel for Any Reason: Reimburses up to the Maximum Limit shown on the Schedule of Benefits if you cancel your Trip for any reason, not otherwise covered under the Policy, up to 48 hours prior to your scheduled departure.

- Rental Vehicle Damage Coverage: Reimburses up to the Maximum Limit shown on the Schedule of Benefits for physical damage to a rental car for which the car rental contract would hold you responsible.

- Wedding Bundle: Trip Cancellation due to wedding cancellation. Coverage does not apply if you are the bride or groom in the wedding.

Family Coverage: One child, age 17 and under, who is booked to travel with and is related to the primary adult named on the enrollment form, is included in the rates for each paying adult. Offer does not apply to optional coverages. The child’s trip cost must be equal to or less than the adult traveler(s) trip cost.

Product Enhancements

New enhancement bundles listed below. Contact Card Player Cruises for the most complete and current information.

Medical Bundle

- Up to an additional $50,000 Travel Medical Expense

- Up to an additional $500,000 Emergency Evacuation and Repatriation of Remains

- Emergency Evacuation - Hospital of Choice

- Up to $5,000 Ancillary Evacuation Benefits

Includes Return Transportation/Baggage Return, Return of Children, Bedside Visit, Bedside Traveling Companion

Adventure Sports Bundle

- Adventure Activities Exclusion Waiver

- Extreme Activities Exclusion Waiver

Security Bundle

- Up to $100,000 Security Evacuation

- Up to $100,000 Flight Guard

- TC/Tl due to civil disorder or riot

Pet Bundle

- Up to $500 ($100/day) pet care 12 hrs.

- Up to $2,500 Pet or Service Animal Medical Expense ($100 deductible)

- TC/Tl due to critical condition or death of domestic dog or cat

Inconvenience Bundle

(Up to $250 per benefit up to an aggregate limit of $750)

- Closed Attractions (ski resort, golf course, amusement park, lack of snow, inclement weather, strike)

- Missing Work

- Flight Diversion

- Rental Vehicle Breakdown

- Bed Rest

- Hotel Infestation

- Hotel Construction

- Baggage Delay

- Trip Delay

- Rental Home Lockout

- Credit/Debit Card Cancelled

Name Your Family

- Name your own family members (up to 5 additional)

Rental Vehicle Damage Coverage Bundle

- Up to $50,000 ($250 deductible)

Wedding Bundle

- Trip cancellation due to wedding cancellation (excludes coverage for the couple getting married)

- Must be purchased within 15 days of initial trip payment

Baggage Bundle

- Up to an additional $1,000 baggage coverage

- Primary baggage coverage

- Up to an additional $300 baggage delay